From 40 to the Indispensable Few: Using Cross-Citations to Spot Market-Ready Patents

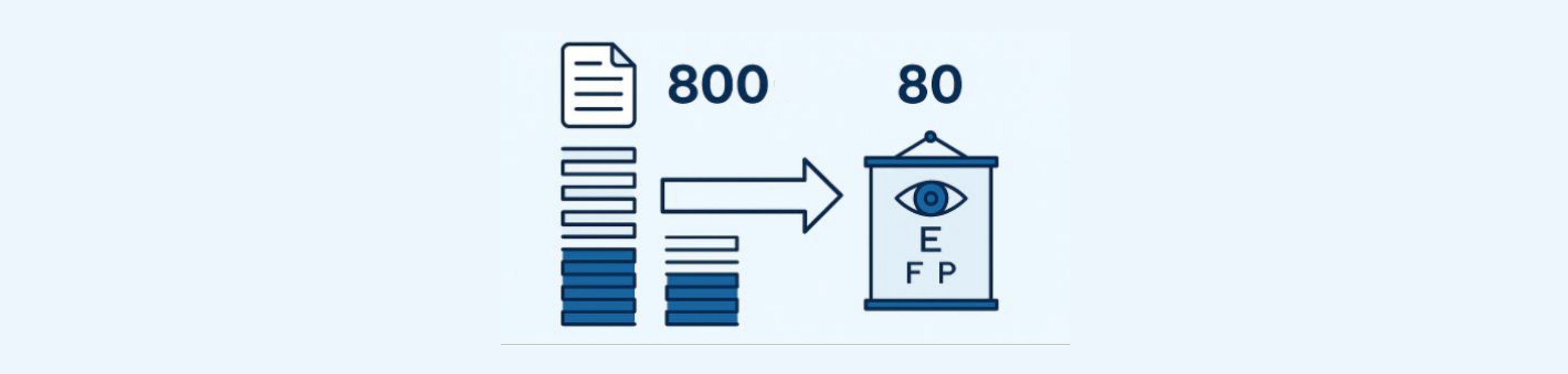

After narrowing from 800 → 80 → 40, we were left with a portfolio of strong, strategically aligned patents. But the client wanted to go one step further: rank these 40 patents to know which ones were truly indispensable from an in-licensing or acquisition standpoint.

At this stage, further manual evaluation added limited value — the client already had their strongest IP assets. What was missing was a way to understand how the industry itself viewed these patents.

That’s where we turned to cross-citations.

Why Citations Beyond the Owner Matter

When a company cites its own patents, it often reflects incremental innovation—important for the owner, but not necessarily transformative for the industry.

But when other companies cite a patent, the story changes. Especially when those citations come from:

- Direct competitors → signaling foundational technologies core to the market.

- Complementary businesses → signaling broader applications and integration across the value chain (e.g., software companies citing drug discovery patents for AI-based pharma solutions).

- Universities or research institutes → often signaling early-stage technology, still maturing for commercialization.

This separation helped us distinguish between patents valuable only to their owners and those seen as enablers by the wider industry.

Clue #3

Cross-Company Citations Signal Commercial Potential

- Patents cited mainly by their own owners often reflect incremental work.

- But when complementary companies across a value chain cite the same patent, it shows broader relevance and commercial potential— making these patents strong candidates for acquisition or in-licensing.

Ranking Through Cross-Company Citations

By grouping citations into these categories, we could see which patents:

- Anchored incremental innovation for their owners.

- Represented core technologies referenced by competitors.

- Showed cross-industry relevance, pointing to commercial potential beyond their original scope.

The last group — those cited widely across the value chain — stood out as the most strategically valuable for acquisition or in-licensing.

They weren’t just strong patents; they were patents the market itself was quietly validating.

The Takeaway

In acquisition-focused evaluations, it’s not only about how many times a patent is cited, but who is citing it.

Cross-company citations act as a market signal, highlighting patents that carry weight across industries and value chains.

For our client, this approach helped turn a shortlist of 40 into an actionable ranking — showing not just what was strong on paper, but what the market itself considered indispensable.